Steve Kelly

CO-FOUNDER AND CHAIRMAN

Think about your last major household purchase. A fancy TV. A new oven. Or maybe a big-ticket item like a roof or furnace. Now think about how you came to your decision. Did you choose the first option you stumbled across, or did you carefully research the possibilities – comparing features, reading consumer reviews, and looking for savings? If you’re like me – and I suspect most consumers – you did your homework because you wanted to feel confident in your decision.

Steve Kelly

CO-FOUNDER AND CHAIRMAN

Think about your last major household purchase. A fancy TV. A new oven. Or maybe a big-ticket item like a roof or furnace. Now think about how you came to your decision. Did you choose the first option you stumbled across, or did you carefully research the possibilities – comparing features, reading consumer reviews, and looking for savings? If you’re like me – and I suspect most consumers – you did your homework because you wanted to feel confident in your decision.

Business leaders go through a similar process when setting budgets, selecting vendors, and making strategic hiring decisions to ensure their businesses grow. And, although they can be quite good at scrutinizing decisions like these, they often fail to apply the same due diligence to what is typically their second largest expense – and the most important benefit to employees.

Unpacking our fiduciary responsibility to spend healthcare dollars wisely.

It won’t surprise anyone when I say the healthcare system is failing consumers at all levels. Whether we’re choosing something small, like where to go for physical therapy, or something more complicated like a new healthcare benefits policy for an entire company, making an informed decision is an uphill battle. And yet, as difficult as it is, I believe it is our duty as employers and as responsible healthcare consumers to demand transparency behind healthcare pricing so we can put quality care within reach of health plan beneficiaries.

Right now, stakeholders in the healthcare sector are pushing to maintain the status quo, and it’s easy to see why. We have inflated, wildly variable pricing on standard procedures from one care setting to another. Billing and debt collection practices are inscrutable at best, if not downright deceptive. Healthcare costs continue rising year after year, and there is no meaningful accountability to the people footing the bill. For stakeholders on the inside, the status quo looks pretty good.

But, if a proposed class action lawsuit recently brought against Johnson & Johnson on behalf of its employees has any teeth, this tide might finally be turning. At the heart of the matter is the concept of fiduciary responsibility. In other words, the duty of employers to invest employee assets wisely and shrewdly – the way any prudent person would. Here’s how the team of legal experts bringing the case against Johnson & Johnson frames it:

“No prudent fiduciary would agree to make its plan and beneficiaries pay a price that is two-hundred-and-fifty times higher than the price available to any individual who just walks into a pharmacy and pays out-of-pocket.” Lewandowski v. Johnson and Johnson, U.S. District Court for the District of New Jersey, No.1:24-cv-00671.

Even if we assume there is no malicious intent at play, we’re still left with an uncomfortable truth. Employees were left paying exorbitant mark-ups that otherwise would have been questioned if the employer was acting as a true fiduciary. This alone is cause for great concern. Instead of throwing employee healthcare dollars into the void and hoping for the best, don’t we owe it to ourselves as business leaders to ask smarter questions and demand transparency in how those dollars are allocated? If I sound offended by the current state of affairs, it’s because I am – as an employer with real families counting on me and as a healthcare consumer myself.

The real price of business-as-usual health benefits.

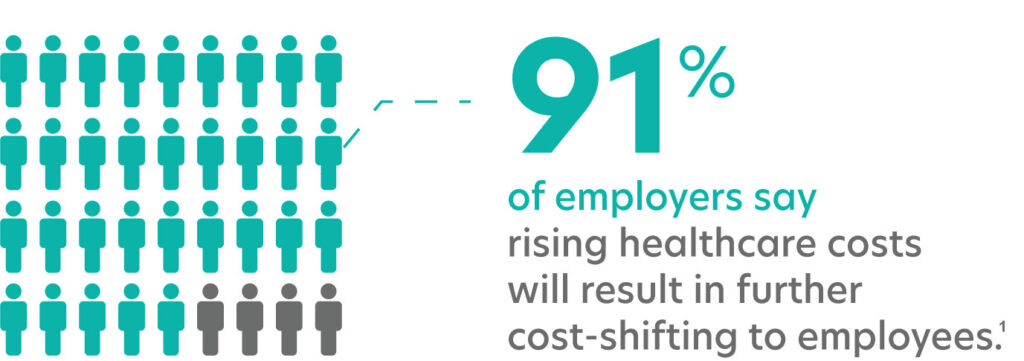

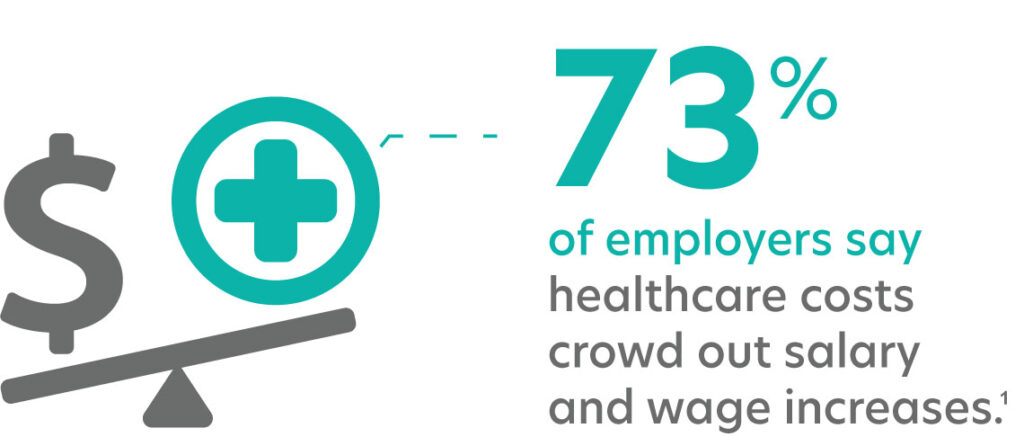

If I find out I overspent on a new TV, I’m not happy about it, but life goes on – largely unchanged aside from a case of buyer’s remorse. But if I overspend on my company’s health benefits program and it fails to perform as expected the consequences ripple throughout the entire organization. Not only does it impact how employees and their dependents access the care they count on, but it also has the potential to effectively erode earnings as out-of-pocket healthcare costs outpace – or completely negate – wage increases.

We also need to remember that these out-of-pocket cost increases do not affect all workers equally, with the lowest earners consistently spending the largest percentage of their income on health insurance premiums. For these people, one unexpected medical bill, trip to the ER, or simply daring to use their high-deductible plan, could be enough to send them into medical debt – or worse to forgo seeking care entirely. Meanwhile, employers are forced to do more with less – making it harder than ever to attract and retain the talent they need to be successful.

What can be done to improve the situation.

It’s not all doom and gloom. New regulations make shopping for health plans more transparent and business owners can more easily compare their healthcare options today than they could just a few years ago. Now it is finally possible for employers to apply the same level of sophistication to their health plan purchasing decisions as they do to other significant capital expenditures. The biggest remaining hurdle? Helping business leaders realize the power lies with them. This is no longer an annual search for the next best stop-gap solution. It can be – and should be – a company-wide cultural sea-change that is supported by transparency and a strategic path forward for the organization.

1 National Alliance of Healthcare Purchaser Coalitions, Pulse of the Purchaser, 2023, 08.

explore other topics