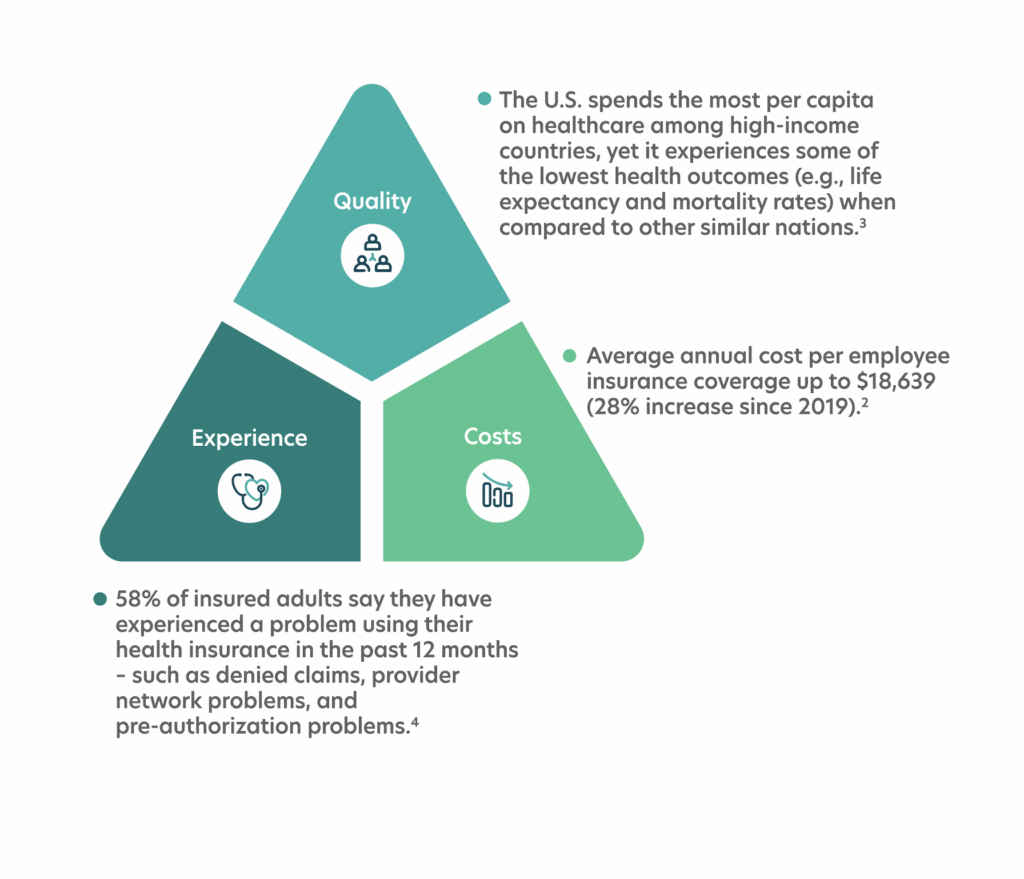

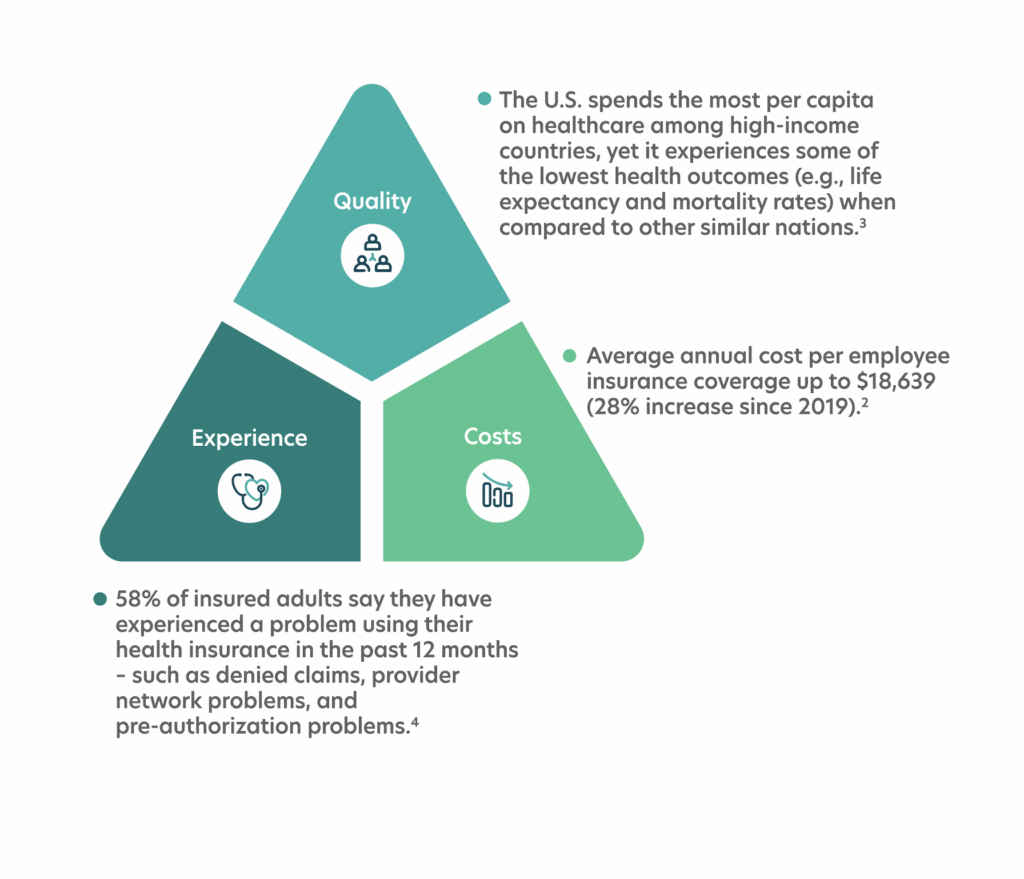

The healthcare triple aim framework has been around for almost 20 years, but that doesn’t mean it should fall off any healthcare company’s radar. Reduced costs, higher quality, and a better experience are what we all should be seeking to achieve. Unfortunately, progress in these areas remains unsatisfactory:

As we continue to seek solutions that drive a meaningful impact in each of these areas, we should pursue opportunities for integrating data and processes. That is what an integrated pharmacy and medical plan model seeks to achieve. In this model the synergies from data integration, aligned processes, and enhanced reporting drive benefits across the triple aim spectrum:

A holistic view of a patient’s health contributes to more effective care coordination and improved medication adherence. |  Better data allows us to identify opportunities to reduce medication costs and prevent unnecessary hospitalizations. |  Better transitions between care encounters help patients receive consistent, high-quality care throughout their healthcare experiences. |

Additionally, medical and pharmacy benefits integration positively impacts all stakeholders. When it comes to employer-sponsored insurance, there are benefits for both employers and their employees:

- Simplified relationship management: Fully integrated plan with one point of contact and seamless administration.

- Transparent, integrated reporting: Real-time data sharing across medical and pharmacy benefits for a full 360-degree view of health plan performance.

- Increased cost savings via bundled product: A comprehensive, transparent pricing proposal.

- Better service: One number to call and integrated portals for medical and pharmacy.

- Improved care outcomes: Delivery of improved expertise and outcomes through medical management programs.

Rethinking the approach to health benefits

In recent years, some employers have opted to carve out pharmacy benefits in an effort to control rising healthcare costs. While well-intentioned, this can lead to fragmented care, a confusing experience for employees, and poorer health outcomes that drive up costs long-term. As a result, some employers are reassessing the quality and effectiveness of their current partnerships and looking at benefit integration as a way to reduce costs and simplify the member experience.

To discuss how an integrated medical and pharmacy model can reduce the costs of your employer self-funded plan by 25 – 30+% reach out today.

1. Medical cost trend – Behind the numbers 2025’, PwC

2. 2025 Employer Health Care Strategy Survey’, Business Group on Health

3. U.S. Health Care from a Global Perspective’, The Commonwealth Fund

4. KFF Survey of Consumer Experiences with Health Insurance’, Kaiser Family Foundation.